Economic planning is essential for navigating uncertain times. Investors need to understand how economic fluctuations impact their portfolios and adjust their strategies accordingly. This requires a deep understanding of market trends and the ability to adapt to changing conditions. A well-defined investment strategy can help mitigate risks and maximize returns. Diversification is key to managing risk in volatile markets. By spreading investments across different asset classes, investors can reduce their exposure to any single market downturn. This approach can help protect capital and ensure long-term financial growth. Understanding the correlation between different asset classes is crucial for effective diversification. Staying informed about economic indicators and market trends is vital for making informed investment decisions. By analyzing data and understanding the factors influencing the market, investors can make more strategic choices. This includes monitoring interest rates, inflation, and other key economic indicators. Regularly reviewing and adjusting investment strategies based on market conditions is essential for long-term success.

Capital Appreciation: Strategies for Long-Term Growth

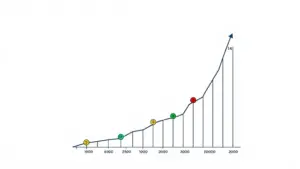

Capital appreciation is a key component of long-term financial growth, requiring careful planning and investment