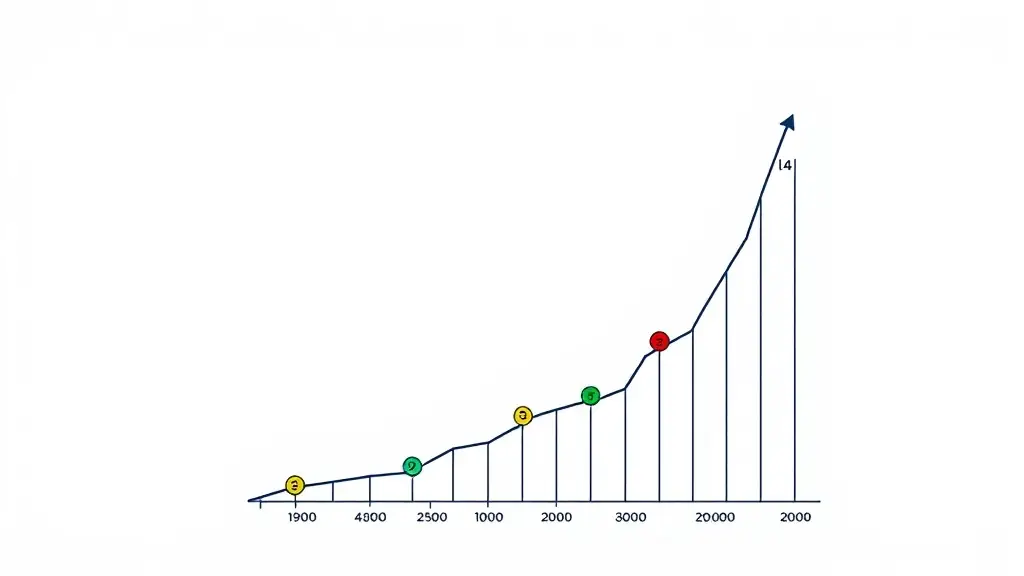

Capital appreciation is the increase in the value of an asset over time. Understanding the factors that drive capital appreciation is crucial for long-term financial growth. This includes market trends, economic conditions, and industry-specific factors. A well-defined investment strategy can help maximize capital appreciation. Diversification is a key strategy for managing risk and maximizing capital appreciation. By spreading investments across different asset classes, investors can reduce their exposure to any single market downturn. This approach can help protect capital and ensure long-term financial growth. Understanding the correlation between different asset classes is crucial for effective diversification. Regular monitoring and review of investment portfolios are essential for capital appreciation. By tracking performance and adjusting strategies as needed, investors can maximize returns. This includes understanding market trends and adjusting investment strategies accordingly. Seeking professional advice from financial consultants can provide valuable insights and guidance.

Capital Appreciation: Strategies for Long-Term Growth

Capital appreciation is a key component of long-term financial growth, requiring careful planning and investment